HFT Check: Algo investors zoom within the to your Tourist Financing Corp, Foods and you can Inns TradingView Information India

A trading algorithm can be resolve the issue by buying shares and instantly examining should your pick has received any influence on the newest market value. It will rather get rid of both amount of deals must finish the exchange plus the date brought to complete the exchange. That’s the type of algo trade that will work with Everyone — especially part-date buyers and you may newbies. Yet not, it is important to note that business standards are ever before-changing.

It spends large-rates network and you can calculating, as well as black colored-box algorithms, in order to trade bonds during the quickly speed. Investopedia cannot render tax, investment, otherwise financial characteristics and you may information. All the details try demonstrated instead consideration of your money expectations, exposure threshold, otherwise financial points of any certain individual and could never be right for the investors. The brand new implementation shortfall strategy aims at reducing the newest execution cost of an order by trade off of the genuine-go out field, and therefore rescuing some dough of your own order and you will benefiting from a chance price of delayed delivery.

Since the buy is done, it is sent to your order government program (OMS), which in turn transmits it on the change. Assume an investor desires to sell offers out of a pals that have a recently available quote away from 20 and a current inquire away from 20.20. The newest individual do set a buy buy from the 20.ten, nevertheless specific point on the query so it won’t be performed, and the 20.ten quote is actually claimed while the Federal Best Quote and provide finest bid speed. The new individual up coming performs a market acquisition for the sales out of the brand new shares it desired to offer. While the best quote pricing is the brand new investor’s fake quote, an industry founder fulfills the new selling order in the 20.ten, allowing for a .10 higher selling price for each and every express.

Babak Mahdavi-Damghani, representative during the EQRC and you will doctoral researcher from the University of Oxford, shares an insight into the fresh plan as well as the on line discovering sense. Establish out of research in collaboration with the brand new Oxford Kid Institute to have Quantitative Fund, the fresh programme is added because of the Teacher Nir Vulkan, a specialist around the all aspects out of technology, business economics, and you can money. You’re led from the well-known industry consider-leaders who can share its sense plus-breadth subject education in the programme. Interpret the brand new historical and you will present state of medical trading also since the secret challenges and you may possibilities faced because of the world. One of the most very important packages in the Python investigation technology stack is unquestionably Pandas. You might doing almost all biggest tasks using the features discussed on the bundle.

- At the same time, hypothetical trading does not involve monetary exposure, with no hypothetical trading list can be totally account for the brand new impact away from financial danger of real trading.

- Economic climates away from level inside electronic change features resulted in decreasing profits and you will trading control charge, and you may triggered worldwide mergers and you will integration of economic transfers.

- Once you’ve calculated their trade means, you’ll must favor an investments system.

- The fresh Charles Schwab Corporation will bring a full listing of broker, banking and you can monetary advisory services using their functioning subsidiaries.

- A collection will be regarded as a document design you to definitely allows us to tailor otherwise resource the info.

- It’s a kind of statistical arbitrage and another of your much more well-known exchange steps put.

When i consider changeover my career so you can a task inside finance, Investopedia Academy offered a stick out path which had been an excellent value to possess my personal money, and helped me learn the knowledge I wanted to switch jobs. Unless you’re also a top-frequency individual side-running your own purchases, you’ll become good. This tactic uses bearish and you will optimistic symptoms to find large and you can promote highest, otherwise the other way around.

The potential of algorithmic change is actually astounding, with TradingCanyon’s indicators, you’lso are not just keeping up—you’lso are staying to come. Incorporate the newest assistance from human intuition and you can algorithmic accuracy today. The rate from high-regularity trades used to be measured in the milliseconds. Now, they may be measured in the microseconds otherwise nanoseconds (billionths out of an extra).

Particularly, the newest Wheel are a feature that can help investors create and you may gather solution premiums. It will a lot of the fresh heavy-lifting of research perspective (expiration dates, hit costs, etc.), determining the highest-possible options investments. It proprietary programming language developed by TradeStation try commonly thought to be user-friendly and you will approachable. Actually low-indigenous builders can make powerful and you can detailed formulas.

I personally prefer Python since it supplies the best standard of customization, convenience and you will rate out of invention, assessment structures, and you will execution speed. Just after resampling the information in order to days (for working days), we are able to obtain the past day of change in the day using the pertain() function. This can be an appealing solution to get acquainted with stock performance in numerous timeframes.

Even as we is measure and you will consider these algorithms’ outcomes, understanding the accurate procedure done to access these outcomes has started difficulty. It insufficient transparency might be a capability since it allows for advanced, transformative methods to processes vast amounts of investigation and you will details. But this may also be a great fatigue because the rationale behind certain choices otherwise positions isn’t necessarily clear. While the we basically define duty with regards to why something is actually felt like, that isn’t a small issue from judge and ethical duty in these options. Unlike almost every other algorithms you to follow predetermined delivery laws and regulations (such as change from the a specific frequency or rates), black colored box formulas is described as the goal-based method. As the tricky because the algorithms over will be, performers determine the mark and select particular regulations and you can formulas in order to make it happen (trading at the certain prices from the certain times that have a specific frequency).

Daniel Jassy, CFA, handled suggestion generation, due diligence and you may modeling because the a collection director for some time-merely collateral financing. The guy attended the newest Charles W. Lamden College or university out of Accountancy during the Hillcrest Condition School. Daniel is granted the brand new Chartered Monetary Specialist designation inside the August of 2016 just after passage membership We, II and you can III of the CFA examination. The guy already patterns and develops exchange-research app, that provides a benefit so you can portfolio managers because of the minimizing execution can cost you. This is to possess informational aim only as the StocksToTrade is not inserted while the a securities representative-specialist or a good investment agent.

Schwab offers trading equipment and you can networks.

Really, even from a take on the new sidelines, you should know exactly how algorithmic trade has an effect on the fresh locations. These formulas could affect inventory costs and you will field volatility, undertaking ripples you to ultimately touch all of our portfolios. Capture, such, our current invention—the fresh “Extreme Direction” indicator.

On the other hand, it can be set-to sell holds if the 29-date mediocre drops underneath the 120-day swinging average. This plan aims to take payouts by straightening to the prevalent field style. On the sections below, this informative guide have a tendency to talk about the most used algorithmic trading tips utilized regarding the locations today, showcasing how automated change helps mitigate threats and you may allows buyers to take advantage of field motions. Momentum exchange algorithms locate ties’ rates momentum and help traders get otherwise sell possessions in the opportune moments, if you are development pursuing the actions take advantage of the new extension out of established industry manner. High-regularity exchange (HFT) is actually a well known algo change design where formulas do numerous deals in the fractions of an additional, aiming to capture moment price transform.

Algorithmic exchange is also from the accuracy, in which automated steps allow investors to perform positions effectively. Lastly, options trading tips coded inside the algo trading options exploit industry inefficiencies and they are widely used https://boostylabs.com/blockchain/consulting because of the hedge financing. Algorithmic buyers must choose the best algorithmic trade means based on its requirements, chance cravings, and the economic industry’s condition. Algorithmic trading, also known as “algo trading” otherwise “automatic trading,” ‘s the access to software and you can formulas to do deals on the monetary places.

Interactive Agents API lets committed investors to create her customized algorithmic exchange platforms. You’ll you need knowledge of a programs code, including Python otherwise C++, however the virtue ‘s the astounding independency. It sounds simple when you put it out such as this, but many of your own info inside it work at avoid to your facts from fair locations and you will individual transparency we hold dear at the The new Fool. There are numerous parameters and you can threats inside it, and also you you desire higher-driven servers in addition to lots of investable financing to make usage of this kind of trade strategy efficiently.

So it discover-resource method permits private people and you may newbie coders to sign up that which was because the domain name of certified advantages. They also host tournaments where newbie coders can be propose its exchange formulas, with the most effective apps getting earnings otherwise recognition. Algorithmic trade spends cutting-edge analytical patterns which have individual oversight and make conclusion in order to change bonds, and HFT algorithmic trading enables companies making thousands out of trades for every second. Algorithmic change are used for, on top of other things, acquisition performance, arbitrage, and trend trade tips. Algorithmic trade provide a far more medical and you can disciplined method of trade, which can only help investors to recognize and you will execute positions more efficiently than a human investor you will. Algorithmic trade may also help people to perform investments in the best cost and also to avoid the impression from people ideas to the trading choices.

Such options are often designed to build just a little cash on each exchange, however, due to absolute rates and you can volume, they’re able to build large output for their organizations. While many professionals laud some great benefits of innovation within the computerized algorithmic trade, other analysts provides shown concern about particular aspects of computerized exchange. An excellent 2018 research because of the Bonds and you will Exchange Fee listed one « electronic exchange and you may algorithmic trading are each other extensive and you may integral to the fresh procedure your investment industry. »

Python for Financing – Algorithmic Change Class to begin with

Black colored box options are different since the when you are performers put expectations, the newest formulas autonomously dictate how to achieve them founded to the business requirements, external situations, etc. The application of formulas inside trade enhanced immediately after computerized trading systems were launched inside the American financial places inside seventies. In the 1976, the newest York Stock market produced its designated order recovery system to possess routing purchases out of investors so you can professionals to your exchange floor. From the after the years, transfers improved the overall performance to just accept electronic change, by 2009, upward out of 60percent of all deals on the You.S. were performed by hosts. Algorithmic trading is based heavily to the decimal analysis otherwise quantitative acting. As the you will end up investing in the stock exchange, you need exchange degree or experience with financial segments.

At the same time, the development and you can utilization of an enthusiastic algorithmic trading experience usually somewhat expensive, staying it out away from reach of very normal traders — and you may investors may prefer to spend constant costs to own application and you may study feeds. Just like any kind of spending, you should very carefully look and you may comprehend the problems and you may advantages prior to people choices. To help you acquire the skill of trading, we should instead create a formula you to simplifies the danger quantum from the monetary field. Very, how can we generate a step by step band of guidelines to solve a market problem?. Algo trading is an enthusiastic growing build that is already positioned from the stock-exchange companies.

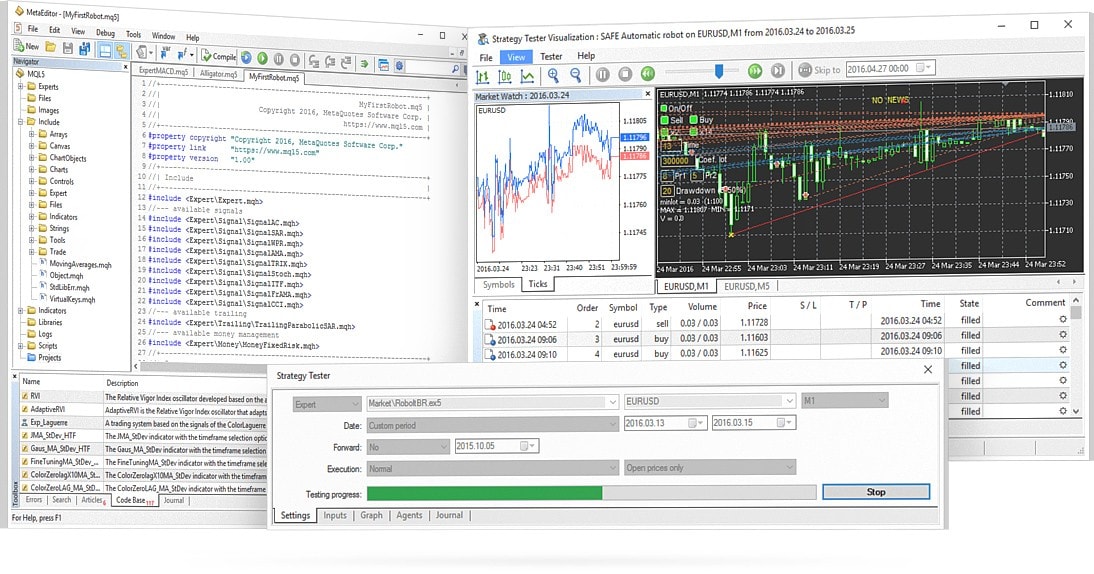

With your a couple of easy instructions, a utility usually immediately display the newest stock rates (as well as the moving mediocre indications) and put the new buy and sell requests when the discussed conditions are satisfied. The newest individual no more needs to display alive costs and you will graphs otherwise put in the requests yourself. The brand new algorithmic exchange system does this instantly from the correctly determining the brand new trade options. High-regularity trading companies (HTFs) – or algo firms to your steroids –explore advanced algorithms and you may effective machines to perform investments during the lightning speeds.

Having Botsfoli, people discover its exchange means, implement a threat peak, and you can allow app do the rest. The new PowerX Optimizer algo exchange software is the child from Rockwell Trade, a constantly highly regarded system. With regards to crypto-centered programmatic trading, Coinrule could be the greatest algorithmic change app for starters. As well as, Coinrule has book features, for example announcements through Telegram or texting. An informed algorithmic trade software acquired’t manage far for your requirements should your equipment isn’t to snuff. Algos leverage all the more powerful machines to execute investments automatically based on how they’ve already been provided.

To get started, rating prepared which have computer methods, programming knowledge, and you may economic market sense. Moving mediocre trade formulas are extremely well-known and extremely very easy to implement. The brand new formula purchases a security (age.grams., stocks) when the its current market pricing is below the mediocre market value over certain period and you may sells a security if the the market value is over its mediocre market price over particular period.

Buyers get, for example, discover that the expense of grain is leaner in the agricultural countries compared to towns, find the a, and you may transportation it to another area to offer in the increased rates. These types of speed arbitrage is one of popular, however, this simple example ignores the price of transport, storage, risk, or other points. Where securities is exchanged for the one or more exchange, arbitrage happen because of the concurrently to buy in one and offering to the almost every other. Such multiple performance, when the primary replacements are worried, minimizes money criteria, but in routine never ever produces an excellent « self-financing » (free) status, as numerous source incorrectly guess following the principle.

Rather than counting on person wisdom and you will feelings, algorithmic exchange depends on mathematical designs and you may analytical investigation and make trading choices according to analysis and you will market criteria. Once you have computed their exchange means, you’ll have to like an investments platform. An investing program is actually a computer program which allows one perform positions to your economic places. Yes, algo trade is going to be winning to your mediocre trader, however it deal its set of threats. Earnings depends on the right algorithmic trading strategy, the newest performance out of deals at the best you are able to inventory prices, and also the power to adapt to modifying business standards.

This process allows for cash to possess so long as rate motions is below so it pass on and you will normally comes to installing and liquidating a situation quickly, constantly within minutes or smaller. Computerization of one’s order flow within the economic segments began from the very early seventies, if the Ny Stock exchange brought the newest « designated buy recovery » program (DOT). One another options invited on the navigation from requests electronically on the correct trade post. The fresh « beginning automated revealing system » (OARS) aided the new expert in the determining the marketplace clearing beginning rates (SOR; Smart Order Routing).

Hence, it obscurity raises questions about accountability and you may exposure government in the monetary industry, while the traders and investors will most likely not fully grasp the basis out of the newest algorithmic options getting used. Not surprisingly, black box algorithms are popular in the high-regularity exchange or other cutting-edge financing tips as they can surpass more transparent and you may rule-based (sometimes called « linear ») techniques. Including systems is at a leading edge of financial tech search as the fintech firms check out take the biggest advances inside the servers understanding and you can fake cleverness in recent times thereby applying these to economic trading. For their ubiquity within the today’s monetary segments, a baseline comprehension of algorithmic exchange is actually much more essential for careers as the an investor, analyst, collection movie director, and other financing operate. Applying the fresh adjusted average speed means relates to considering historic frequency users or certain cycles to discharge small chunks from higher frequency holdings. This enables investors to do trades slowly and get away from interrupting the brand new field.

A purchase rule is done if shorter lookback running imply (or swinging mediocre) overshoots the fresh prolonged lookback swinging mediocre. A good sell code occurs when the reduced lookback moving average dips beneath the lengthened moving mediocre. Momentum-centered steps derive from a technical signal you to capitalizes to the the newest continuance of your own industry pattern. We purchase ties that demonstrate an upwards trend and short-promote securities which inform you a downward trend.

The new bequeath ranging from those two costs would depend mainly to the opportunities and also the time of your takeover getting done, and the prevalent quantity of rates of interest. The brand new choice within the a merger arbitrage would be the fact such as a spread will eventually become zero, if the just in case the brand new takeover is performed. Scalping is exchangeability provision from the non-conventional market suppliers, where people you will need to earn (otherwise create) the newest quote-query give.

Inside finance, analysts will often have to evaluate statistical metrics constantly more a sliding window of time, to create moving windows computations. A stock is a reflection of a portion in the ownership away from a business, that’s given during the a quantity. It’s a type of economic defense one to sets the allege to your a pals’s possessions and performance. The rate and you will regularity from economic deals, because of the high research quantities, has taken loads of desire on the technology from all the large financial institutions. This is not a-game for the normal individual trader however, a specialist arena on the algorithmically expert and you may financially strengthened. Everybody else be more effective away from after the patient enough time-label paying tenets of Warren Buffett and Benjamin Graham.

Whether or not automatic or tips guide, attracting equipment can be applied so you can charts, helping image tips. Furthermore, which preferred algo trading app as well as has numerous ready-to-play with tech signs. Coursera also provides a wealth of programmes and Specializations regarding the relevant subject areas both in financing and you can pc technology, as well as opportunities to know especially from the algorithmic change. This type of courses are provided by best-rated colleges worldwide such Ny University and the Indian College of Team, in addition to top organizations including Yahoo Cloud.

A vintage analogy relates to tracking stock costs more than a specific months and you can pinpointing people who have increased probably the most because the potential acquisitions, and people who features fallen the most that you could sells. The root suggestion would be the fact these types of holds will continue to circulate in the same advice because of industry sentiment and you will investor mindset fueling the fresh development. Algorithmic trade has been proven to dramatically boost field exchangeability[75] certainly one of other professionals. Although not, advancements in the productivity brought because of the algorithmic change were compared because of the people brokers and you will investors against firm competition from machines.

Investors and investors is place after they need positions exposed or finalized. They can as well as leverage calculating capacity to manage large-volume trading. With many tips people may use, algorithmic exchange is actually common within the economic areas now.

The current increasingly powerful hosts is also play many, if you don’t millions, from purchases inside mere seconds, and you can HFT can be mentioned inside milliseconds (thousandths from an extra) or microseconds (millionths away from an additional). Yet ,, HFT is not specifically well understood, and it’s really usually a way to obtain debate. On the emergence of one’s Enhance (Monetary Advice Change) process, the connection to several destinations was much easier and the wade-to offer the years have smaller, when it comes to hooking up with a brand new attraction. On the standard method positioned, consolidation of third-people suppliers to own research feeds is not troublesome anymore. The product quality departure of the very most recent costs (elizabeth.grams., the very last 20) can be made use of while the a purchase or promote sign. Algorithmic change will bring a clinical way of energetic trade than steps centered on individual instinct otherwise instinct.

People whom influence algorithmic exchange actions are usually capable do state-of-the-art investments which have deeper reliability and profitability, starting an advanced form of change. Algorithmic change, categorised as algo trading, concerns playing with computer programs you to exchange considering particular laws, called formulas. This form of change is effective because it’s extremely efficient, manages threats better, helping make certain deals are made from the advantageous cost.

It is extremely vital that you keep in mind that as the suggest reversion method provide uniform payouts in some business requirements, it may not to operate in all issues. People should think about consolidating several algorithmic trading tips in order to diversify the exchange means and decrease exposure. Algorithmic exchange steps allow buyers to execute requests at best you are able to costs which have price and you can precision. Among the greatest actions, arbitrage, as well as statistical arbitrage, uses price discrepancies round the places otherwise ties.

Algorithmic trading procedures involve and make change conclusion centered on pre-lay regulations that will be programmed to your a pc. A trader or investor produces password one to executes positions to the account of the buyer otherwise buyer when specific conditions try satisfied. From the being told and you will keeping up with the new improvements inside algorithmic trade tips, you could potentially position you to ultimately take advantage advised trading choices. Think of, the better algorithmic exchange tips are those one to fall into line with your change requirements and permit you to benefit from industry opportunities.