100percent Back In Bonus Rewards On Duracell Coppertop Aa

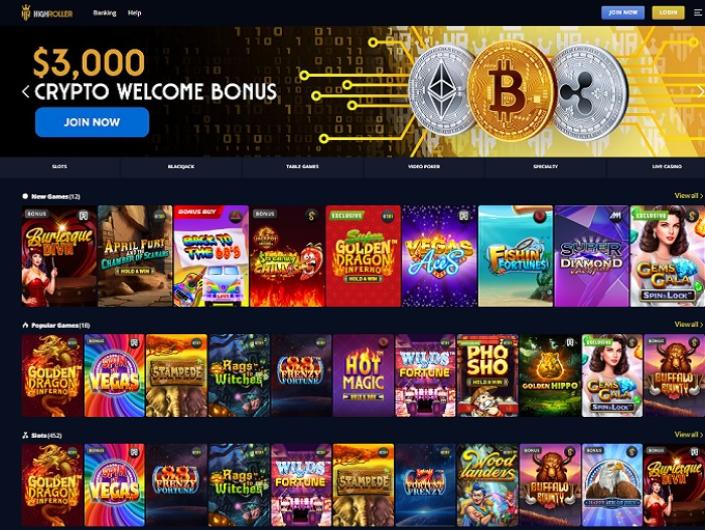

Online casinos are pretty creative and come up with unique bonuses and promotions, which may fall outside of the abovementioned categories. Alternatively, casinos sometimes offer a combination of bonuses merged into one no deposit offer, such as an amount of bonus funds and a number of free spins. When a bonus is exclusive, it means it is only offered to some players or through certain channels.

- As a result of switching to EBIT, the threshold for hitting the limitation on interest deductibility will become lower , and businesses that invest more could be at greater risk of hitting the threshold, as the accompanying table illustrates.

- Idaho does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.ILNo.

- You can use tax software to help you file your business tax return.

- Growing businesses with low net income might prefer to spread out the cost of their assets over their useful lives.

- The bonus depreciation calculation will depend on the year you placed the asset in service.

For many years, businesses have been incentivized to invest in new equipment and https://casinolead.ca/royal-vegas-casino/ property, knowing Section 179 expensing and bonus depreciation rules would allow them to deduct 100percent of their capital expenditures. Tax Foundation’s General Equilibrium Model computes tax items related to investment and cost recovery. Empirical research indicates tax losses reduce the incentive of firms to respond to tax changes.

Start Collecting Your 100percent Bonus

It’ll continue to be reduced each year until the deduction will be 0percent by 2027. « Wipfli » refers to Wipfli LLP, a Wisconsin limited liability partnership, and its subsidiaries. Assurance, tax and consulting services are offered through Wipfli LLP. Investment banking and related services are offered through Wipfli Corporate Finance LLC. Wipfli LLP is a member of Allinial Global, an association of legally independent firms.

The Basics Of Cost Segregation

The inability to immediately use a full deduction and instead needing to wait to take it in the future thus results in similar issues to delayed depreciation deductions. The 100 percent bonus depreciation phaseout will also increase the after-tax cost of domestic investment, thereby discouraging otherwise productive investments from occurring. Failure to provide expensing on a permanent basis limits the economic benefit of expensing because the cost of capital again rises when the policy expires, and it may further induce timing shifts rather than level increases in investment.

Qualified used property In addition to meeting the requirements above, other rules apply to used property. An entity that places more than 2,890,000 of property in service during the tax year will see its maximum deduction gradually phased out by the amount in excess of that cap. Qualified property does not include land or real property, such as buildings. Players can check any bonuses they have, alongside information on expiry dates, redemption point requirements and more under the ‘My Rewards’ menu. You can view any bonuses you have, alongside information on expiry dates, redemption point requirements and more, under the ‘My Rewards’ menu.

The bill increases the maximum amount businesses can expense on depreciable business assets. The bill delays the beginning of the phaseout of 100percent bonus depreciation from 2023 to 2026. Without this retroactive treatment, bonus depreciation would be 80percent in 2023 and 60percent in 2024. You can check out our full list of the best no deposit bonuses at US casinos further up the page.

For the most up-to-date and relevant information, consult one of these advisors. However, Kansas has not explicitly conformed to or decoupled from the Tax Cuts and Jobs Act, but it does adopt the current IRC. The starting point for determining a corporation’s Kansas taxable income is federal taxable income. A corporation’s Kansas taxable income is its federal taxable income after net operating-loss deduction and special deductions for the tax year with the modifications.KYNo. If the bonus depreciation deduction creates a net operating loss for the year, the company can carry forward the net operating loss to offset future income. Yes, usually you can withdraw a no deposit bonus after you’ve met the T&Cs.